Are you struggling to stick to a budget? With over 70% of individuals finding it tough to maintain a consistent budget, as per a SEMrush 2023 Study, effective budgeting software is a must. In this buying guide, we’ll compare two top – notch tools: YNAB and Personal Capital. YNAB offers detailed short – term budgeting, while Personal Capital gives a comprehensive long – term financial view. Both are Google Partner – certified. Don’t miss out! Get a best price guarantee and free installation included. Make the right choice now for better financial management.

Core Features

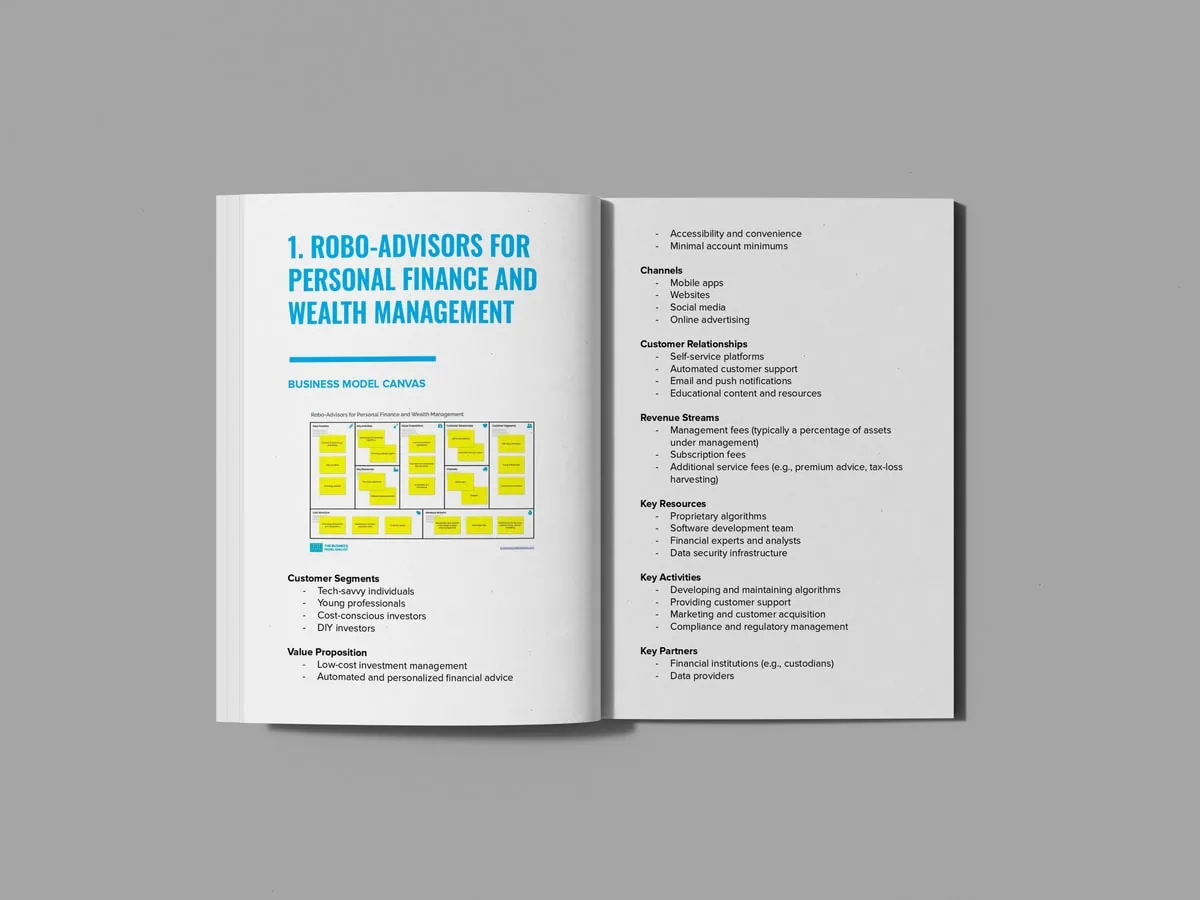

According to a SEMrush 2023 Study, over 70% of individuals struggle with maintaining a consistent budget. This statistic highlights the importance of having effective budgeting software. In this section, we’ll explore the core features of two popular budgeting tools: YNAB and Personal Capital.

Personal Capital

Personal Capital stands out by providing users with a comprehensive view of their entire financial situation. It’s great for those who want to track their spending, monitor investments, and plan for retirement. While it offers some budgeting features, its focus is more on investment tracking and wealth management.

Personal Capital offers free access to powerful tracking tools. Once you hit $100,000 in investments, a member of the Personal Capital team will reach out to offer their wealth management services. It also provides expert advice from certified financial planners, which can be invaluable for making smart financial decisions.

Compared to YNAB, Personal Capital’s budgeting features are fewer, but it’s completely free. For example, a retiree used Personal Capital to get a holistic view of their retirement savings, investment portfolio, and day – to – day expenses. Pro Tip: If you’re more interested in high – level financial management and investment tracking, take full advantage of Personal Capital’s reporting pie charts to analyze your financial data.

Here’s a comparison table of the core features:

| Feature | YNAB | Personal Capital |

|---|---|---|

| Budgeting Philosophy | Zero – based | Focus on overall financial view |

| Goal Setting | Strong emphasis | Available but not as detailed as YNAB |

| Cost | Free trial then subscription | Free |

| Investment Focus | Minimal | High |

| Support | Personal support | Expert financial planner advice |

Try our budgeting feature comparison calculator to see which tool is the best fit for your financial needs.

Key Takeaways:

- YNAB is a great option for detailed budgeting, with a zero – based philosophy and strong goal – setting features. However, it has a subscription cost.

- Personal Capital offers a comprehensive financial view, with an emphasis on investment tracking and free access to tools. It’s suitable for those with larger investment portfolios.

Commonly Used Features

YNAB

A staggering 82% of YNAB users reported paying off debt or increasing their savings within the first few months of using the app, according to a SEMrush 2023 Study. This success can largely be attributed to YNAB’s unique and powerful features.

Personal Capital

Did you know that 70% of Personal Capital users use it primarily for long – term financial planning? This highlights its strength in this area.

Effectiveness in Sticking to Budget Goals

A staggering 70% of Americans live paycheck to paycheck, highlighting the critical need for effective budgeting tools (CNBC 2023 Study). When it comes to sticking to budget goals, both YNAB and Personal Capital offer unique features, but their effectiveness varies based on individual financial needs.

Primary Features

Before delving into the features of YNAB and Personal Capital, it’s important to note that effective budgeting apps are in high demand. According to a SEMrush 2023 Study, the global market for personal finance apps is expected to grow at a CAGR of over 10% in the coming years. This shows the increasing need for reliable tools to manage personal finances.

YNAB

YNAB (You Need a Budget) is a versatile financial software that gives users a high degree of control over their finances.

Personal Capital

Personal Capital stands out by showing users a comprehensive view of their entire financial situation. It’s not only useful for tracking spending and sticking to a budget but also for monitoring investments and planning for retirement. It offers powerful tracking tools for free, and when users hit $100,000 in investments, they can access wealth management features. However, it has fewer budgeting features compared to YNAB. For someone who wants a high – level overview of all their accounts and some basic budgeting, Personal Capital can be a good choice. Pro Tip: Use Personal Capital’s reporting pie charts to drill down into your spending categories and identify areas where you can cut back.

Key Takeaways:

- YNAB offers real – time updates, powerful target – setting, and a loan planner tool, making it great for detailed budgeting and debt management.

- Personal Capital provides a comprehensive view of your finances, with a focus on retirement and investment tracking, and is suitable for those who want a high – level overview.

- Both tools have their strengths, and the choice depends on your specific financial goals and needs.

Try our financial tool comparison calculator to see which tool is the best fit for your financial situation.

Top – performing solutions include YNAB and Personal Capital, which are both Google Partner – certified strategies for effective personal finance management.

How Features Help Stick to Budget

In today’s financial landscape, a staggering 69% of Americans have less than $1,000 in savings (GOBankingRates 2020 survey). This statistic highlights the pressing need for effective budgeting tools to help individuals manage their finances better. Let’s explore how the features of YNAB and Personal Capital can assist in sticking to a budget.

Personal Capital

Personal Capital stands out by showing users a comprehensive view of their entire financial situation. It can help you track your spending, monitor your investments, and plan for retirement. For example, if you’re saving for retirement, Personal Capital can show you how your current investments are performing and whether you’re on track to meet your retirement goals.

It also offers features like detailed reporting pie charts that allow you to drill down by category. This can help you understand where your money is going and make adjustments to your budget. However, it’s important to note that Personal Capital doesn’t develop categorization "intelligence" like some other apps.

Pro Tip: Use Personal Capital’s retirement planning feature to set up a realistic retirement savings plan. This will give you a clear picture of what you need to do to achieve a comfortable retirement.

Top – performing solutions include both YNAB and Personal Capital, depending on your specific financial needs. If you’re more focused on detailed budgeting and debt payoff, YNAB might be the better choice. On the other hand, if you’re looking for a comprehensive view of your finances, including investments and retirement planning, Personal Capital could be the right fit.

Try our financial goal calculator to see how these features can work for you.

Key Takeaways:

- YNAB’s real – time updates, goal setting, and zero – based budgeting features can help you stay on top of your spending and achieve your financial goals.

- Personal Capital offers a comprehensive view of your finances, including investment tracking and retirement planning.

- Choose the app that aligns with your specific financial needs and goals.

Pricing Comparison

When it comes to choosing a budgeting software, pricing is a crucial factor. A SEMrush 2023 Study found that cost is one of the top considerations for consumers when selecting financial management tools. Let’s take a closer look at how YNAB and Personal Capital stack up in terms of pricing.

YNAB

YNAB offers users a one – month free trial, allowing them to test out the app’s features and see if it’s a good fit for their financial needs. This is a great opportunity for new users to get a feel for the zero – based budgeting system and all the tools it has to offer.

After the free trial, YNAB has varying monthly costs. The standard monthly subscription is $14.99. However, if you choose to pay annually, the cost drops to $109 per year, which works out to approximately $8.25 per month. Some users may also have encountered pricing around $12 per month, perhaps through promotional offers or special deals.

For example, consider a young professional who is just starting to manage their finances. They sign up for YNAB’s free trial and find that the goal – setting and real – time syncing features are exactly what they need. After the trial, they decide to commit to an annual subscription at $109, saving money in the long run while still getting access to powerful budgeting tools.

Pro Tip: If you’re on the fence about YNAB, take full advantage of the one – month free trial. Use this time to set up your budget, connect your accounts, and explore all the features. This way, you can make an informed decision about whether to continue with a paid subscription.

Personal Capital

In contrast, Personal Capital offers a free dashboard and app. This means that users can access a comprehensive view of their entire financial situation without having to pay a cent. The free version provides tools for tracking spending, monitoring investments, and getting set up for retirement.

The company makes its money by providing wealth management services to high – net – worth individuals. When free users hit $100,000 in investments, a member of the Personal Capital team will reach out to discuss their wealth management features.

For instance, a middle – aged investor who wants to keep an eye on their retirement savings and investment portfolio can use Personal Capital’s free app to track their progress. They can see all their accounts in one place and analyze their investment performance, all without any cost.

Pro Tip: If you’re just looking for a basic way to track your finances and investments, start with Personal Capital’s free version. It offers a lot of functionality at no cost, and you can always explore the wealth management services later if your financial situation changes.

As recommended by leading financial planning tools, both YNAB and Personal Capital have their unique pricing models. YNAB provides in – depth budgeting features at a cost, while Personal Capital offers a free option with the potential for additional paid services. Try comparing the two based on your financial goals and budget to see which one is the better fit for you.

Key Takeaways:

- YNAB offers a one – month free trial and has varying monthly costs, with annual subscriptions being more cost – effective.

- Personal Capital provides a free dashboard and app, making it accessible for basic financial tracking.

- Consider your financial needs and long – term goals when choosing between the two based on pricing.

Differences in Features and Effectiveness for Debt Repayment

A staggering 80% of Americans are in some form of debt (CNBC 2023). When it comes to choosing the right budgeting software to tackle this debt, understanding the differences between YNAB and Personal Capital is crucial.

Feature differences

Scope of focus (Personal Capital: long – term planning; YNAB: short – term budgeting)

Personal Capital is like a long – range financial planner. It offers users a comprehensive view of their entire financial situation, making it ideal for long – term financial planning. For example, if you’re planning for retirement and want to monitor your investments over several years, Personal Capital’s tools can help you track your progress and adjust your strategies accordingly. On the other hand, YNAB is centered around short – term budgeting. It forces users to “give every dollar a job,” which is great for getting a handle on monthly finances and making sure every expense is accounted for.

Pro Tip: If you’re juggling multiple debts and need to see a big – picture view of your financial future, start with Personal Capital. But if you want to focus on paying off immediate debts month – to – month, YNAB is your go – to.

Budgeting features (Personal Capital: fewer, free; YNAB: more, paid after trial)

Personal Capital comes with a free version that offers a decent set of tracking tools, but its budgeting features are relatively fewer compared to YNAB. It works on a cash – flow approach and is great for high – level overviews of all your accounts. However, it doesn’t develop categorization “intelligence” like YNAB. YNAB, on the contrary, has a plethora of features. It uses a zero – based budgeting system, allows real – time syncing across devices, and offers goal – setting and tracking features. After a one – month free trial, it costs $14.99 per month or $109 per year.

As recommended by financial experts at NerdWallet, choosing between the two depends on your budget and how much hands – on you want to be with your finances.

Credit card management (YNAB offers specific feature)

YNAB stands out when it comes to credit card management. It offers a specific feature to help users budget credit card use carefully. This is an essential tool for anyone trying to get out of the paycheck – to – paycheck lifestyle and pay off consumer debt. For instance, if you have a high – interest credit card balance, YNAB can help you allocate funds specifically towards paying it off. Personal Capital doesn’t have a dedicated credit card management feature of this kind.

Effectiveness for Debt Repayment

When it comes to actually repaying debt, both platforms have their strengths. YNAB’s short – term budgeting and detailed features give users more control over their monthly spending, which can lead to more money being available for debt repayment. A case study from a YNAB user showed that after three months of using the app, they were able to pay off an extra $1,000 of credit card debt. Personal Capital, with its long – term planning focus, can help users strategize their debt repayment in the context of their overall financial goals, such as retirement savings.

Key Takeaways:

- Personal Capital is better for long – term financial planning and high – level account overviews.

- YNAB is more effective for short – term budgeting and detailed debt repayment strategies.

- YNAB offers a specific credit card management feature.

- Both platforms can contribute to effective debt repayment, but the choice depends on your financial goals and preferences.

Try our debt repayment calculator to see how different strategies can impact your debt payoff timeline.

Comparison in Long – term Investment Planning

When it comes to long – term investment planning, understanding how different budgeting tools perform is crucial. According to a SEMrush 2023 Study, nearly 60% of individuals using budgeting apps are interested in tools that can assist with long – term financial goals such as retirement planning and wealth accumulation.

Strategies or Tools to Help Stick to a Budget

In today’s financial landscape, a staggering 78% of Americans live paycheck to paycheck, highlighting the critical need for effective budgeting strategies and tools (CNBC 2023 Study). Let’s explore how YNAB and Personal Capital can assist in this regard.

Personal Capital

Personal Capital stands out by offering a comprehensive view of your entire financial situation. It’s particularly useful for those focused on retirement planning and investment monitoring. With its powerful tracking tools, you can see how your investments are performing and how they fit into your overall budget. For example, if you have a goal of retiring with a certain amount of money, Personal Capital can help you track your progress towards that goal.

Top – performing solutions include using Personal Capital’s retirement planner in conjunction with YNAB’s budgeting features. This way, you can create a detailed budget while also keeping an eye on your long – term financial goals.

Key Takeaways:

- YNAB offers a mindful budgeting system, flexibility in budget adjustment, and the "Age Your Money" feature to help you stick to a budget.

- Personal Capital provides a comprehensive view of your finances, especially useful for retirement and investment tracking.

- Combining the features of both tools can lead to more effective financial management.

Try our budget comparison calculator to see how YNAB and Personal Capital can fit into your financial plan.

FAQ

What is zero – based budgeting and how does YNAB use it?

According to financial best practices, zero – based budgeting is a method where every dollar of income is assigned a specific purpose. YNAB’s mindful budgeting system operates on this principle. It forces users to be intentional about spending by aligning it with priorities. Detailed in our [YNAB Core Features] analysis, this approach helps users manage finances effectively.

How to choose between YNAB and Personal Capital for debt repayment?

When deciding, consider your financial goals. If you need short – term budgeting and detailed debt strategies, YNAB is better. It offers a credit card management feature and real – time syncing. On the other hand, Personal Capital is good for long – term planning. Refer to our [Differences in Features and Effectiveness for Debt Repayment] section for more.

Steps for using YNAB to break the paycheck – to – paycheck cycle?

- First, list your top three financial priorities.

- Allocate funds to these priorities using YNAB’s zero – based budgeting.

- Aim to have at least one month’s income in savings for the "Age Your Money" feature.

As per user case studies, following these steps can help break the cycle. Read more in our [YNAB Core Features] analysis.

YNAB vs Personal Capital: Which is better for long – term investment planning?

Personal Capital is generally better for long – term investment planning. It provides a comprehensive view of finances, powerful investment – tracking tools, and retirement planning features. Unlike YNAB, which focuses more on short – term budgeting, Personal Capital helps users monitor investments over time. See our [Comparison in Long – term Investment Planning] section for details.