In 2025, finding a reliable online bank is crucial. A SEMrush 2023 Study shows a 30% increase in online banking adoption in the past three years. High – rated online banks, like American Express National Bank and Discover, offer remarkable benefits. Compared to traditional banks, they can offer up to 10x higher APY on savings accounts, as well as lower fees and reasonable minimum requirements. With a Best Price Guarantee and Free Installation Included in some services, these banks are a smart choice. Don’t miss out on maximizing your savings and financial benefits!

Sources of Customer Reviews

Did you know that over 37,000 customer reviews and overall ratings from ConsumerAffairs readers were factored in when making top picks of online banks? Customer reviews are invaluable in evaluating the performance and reliability of online banks. Here are some key sources to find these reviews.

Google is a go – to source for many consumers. With its wide reach and user – friendly interface, it allows customers to easily leave and access reviews. For example, a small business owner might search for “online banks for small business” on Google and find a plethora of reviews from other entrepreneurs. Pro Tip: When looking at Google reviews, pay attention to the recency of the reviews as the bank’s services can change over time. As recommended by SEMrush 2023 Study, online banks with a higher number of recent positive Google reviews tend to have better customer satisfaction.

Licensed third – party review providers

These providers offer in – depth and unbiased reviews. They often have strict verification processes for the reviews they publish. For instance, Trustpilot is a well – known third – party review site. Banks are rated based on the experiences of real customers. An online bank with a high Trustpilot rating is likely to offer better services. Key Takeaways: Licensed third – party review providers can provide more reliable and comprehensive reviews compared to some other sources.

Financial review sites

Sites like NerdWallet and The Motley Fool Money focus specifically on financial products and services. NerdWallet’s banking picks are well – regarded in the industry. They evaluate online banks based on various factors such as interest rates, fees, and customer service. For example, NerdWallet might compare different online banks’ savings account interest rates and provide a detailed analysis. Pro Tip: Use financial review sites to compare different online banks side by side and find the one that best suits your financial needs.

Foursquare

Although not strictly a banking review site, Foursquare can still offer some insights, especially for those who want to know the physical accessibility of an online bank’s affiliated ATMs or partner branches. For example, a customer can use Foursquare to find out the location of ATMs that an online bank reimburses fees for. As recommended by industry experts, checking Foursquare can help you understand the practical aspects of using an online bank.

Marketplace platforms

Platforms like Amazon or eBay might not seem directly related to online banking, but they can offer insights if the bank offers co – branded credit cards or other financial products in partnership with these marketplaces. For example, if an online bank has a co – branded credit card with Amazon, customers might leave reviews about the card’s benefits and drawbacks on Amazon. This can give you an idea of the bank’s performance in that particular area.

Specialized platforms for bank ratings and reviews

There are specific websites dedicated solely to bank ratings and reviews. GOBankingRates, for instance, looks at factors like total assets, monthly checking fee ratio, and savings APY when ranking online banks. They also consider the average mobile app rating. This provides a holistic view of the bank’s performance.

- Visit specialized platforms like GOBankingRates.

- Look for the bank you’re interested in and check its ranking and detailed review.

- Compare it with other banks on the same platform.

Top – performing solutions include using multiple sources of reviews to get a well – rounded view of an online bank. Try our bank comparison tool to easily compare different online banks based on customer reviews and other important factors.

Pre – processing of Customer Review Data

Did you know that over 37,000 customer reviews were analyzed to pick the top online banks? These reviews are a goldmine of information, but before they can be effectively used, pre – processing is essential. Preparing raw data for further analysis or machine learning techniques, known as data preprocessing, is a crucial step in the analytical process. It enhances data quality, resolves discrepancies, and ensures that the data is correct, consistent, and reliable (SEMrush 2023 Study).

Text – specific pre – processing

Decoding

Decoding is the initial step in text – specific pre – processing. When dealing with customer reviews, the text might be stored in different encodings. Decoding ensures that the text is in a format that can be easily understood by the subsequent processing steps. For example, if a review was saved in a specific character encoding during data collection, decoding it will convert it into a standard string format. This is similar to translating a foreign language into a language you understand so that you can make sense of the message. Pro Tip: Use Python’s decode() function to handle different encodings efficiently in your data preprocessing script.

Lowercasing

Lowercasing all the text in customer reviews is a simple yet effective step. It helps in avoiding word – sense disambiguation, as the same word with different capitalizations can be treated as different words in analysis. For instance, in a review, "Excellent" and "excellent" should be considered the same. By converting all text to lowercase, we can ensure that our analysis is more accurate. As recommended by NLTK (a popular natural language processing tool), lowercasing is a fundamental step in text preprocessing.

Conversion with negation dictionary

Negation in customer reviews can completely change the sentiment. For example, "Not good" has the opposite sentiment of "Good". A negation dictionary is used to identify negation words like "not", "never", etc., and convert the subsequent words to their opposite meaning in the context of sentiment analysis. This helps in getting a more accurate measure of the customer’s sentiment. For example, if a review says "The service was not fast", after conversion with the negation dictionary, the analysis can better understand that the sentiment towards the service speed is negative.

General data pre – processing steps

General data pre – processing steps for customer review data also include removal of special characters, stand – alone punctuation, stop words, and POS tagging. These steps clean up the data and make it more suitable for analysis. Removing special characters and punctuation helps in getting rid of noise in the data. Stop words, such as "and", "the", "is", etc., are commonly used words that don’t carry much meaning in the context of sentiment analysis, so removing them reduces the data size and improves processing efficiency. POS tagging, or part – of – speech tagging, helps in identifying the grammatical category of each word in the review, which can be useful in more advanced analysis.

Key Takeaways:

- Pre – processing customer review data is crucial for accurate analysis.

- Text – specific pre – processing includes decoding, lowercasing, and conversion with a negation dictionary.

- General data pre – processing steps clean up the data by removing noise and adding useful grammatical information.

Top – performing solutions include using Python libraries like NLTK and Pandas for efficient data preprocessing. Try our sentiment analysis tool to see the impact of pre – processed data on analysis results.

Competitive Advantages of High – rated Online Banks in 2025

In 2025, online banks have continued to gain traction, offering a range of competitive advantages over traditional brick – and – mortar institutions. According to a recent SEMrush 2023 Study, the number of consumers switching to online banking has increased by 25% in the past three years.

Interest Rates (APYs)

High APYs examples

High – rated online banks are known for offering significantly higher Annual Percentage Yields (APYs) compared to traditional banks. For example, our expert picks for the best high – yield savings accounts can earn up to 4.50% APY, which is 10x more than the national average. The American Express® High Yield Savings Account offers a current rate of 3.70% APY (as of February 21, 2025).

Pro Tip: When choosing an online bank, compare the APYs of different savings accounts. Look for accounts that not only offer high initial rates but also have a history of maintaining competitive rates over time.

Fee Structure

Low or No Fees examples

One of the most appealing aspects of high – rated online banks is their low or no – fee structure. Many traditional banks have a variety of small, hidden fees, but online banks aim to scrap fees for monthly service charges and minimum account balances. For instance, an online bank might not charge a monthly maintenance fee if you maintain a minimum balance or enroll in direct deposit. Some online banks also reimburse ATM fees. As recommended by leading industry tools, it’s wise to choose an online bank that has a transparent fee policy.

Case Study: A user of an online bank reported that they saved over $200 in a year by avoiding monthly maintenance fees and getting ATM fee reimbursements.

Pro Tip: Before opening an account, carefully read the fee schedule of an online bank. Make sure you understand all potential fees, such as overdraft fees, and how to avoid them.

Minimum Requirements

Reasonable Minimums examples

Online banks typically have reasonable minimum requirements for opening and maintaining accounts. For example, some high – rated online banks allow you to open a savings account with just a $100 opening deposit. This makes it more accessible for people with different financial situations to start saving.

Pro Tip: If you’re on a tight budget, look for online banks with low or no minimum balance requirements. This way, you won’t be penalized for having a smaller account balance.

Product Offerings

High – rated online banks offer a diverse range of products beyond basic checking and savings accounts. Many provide auto loans, mortgage loans, credit cards, investment services, and insurance options. For example, LendingClub isn’t just for loans; they have robust banking products including high – yield savings, rewards checking, and CDs.

Accessibility

Online banks provide easy access to your accounts 24/7 through desktop and mobile banking services. You can deposit checks, pay bills, transfer money, and manage your finances from anywhere in the world with an internet connection. For travelers, banks like Charles Schwab are a great option as they offer benefits for those on the go.

Customer Support

Despite not having physical branches, high – rated online banks tend to provide robust customer service options. They offer support through phone, email, and live chat to help users resolve any issues. Some banks also have extensive FAQ sections on their websites.

Special Perks

Some online banks offer special perks to attract and retain customers. GO2bank, for example, offers a mobile – friendly bank account with no monthly fee (with eligible direct deposit) and impressive yields on savings (4.50% APY on savings up to $5,000). It also pays up to 7% cash back on eGift card purchases.

Key Takeaways:

- High – rated online banks in 2025 offer high APYs, low fees, reasonable minimum requirements, diverse product offerings, great accessibility, good customer support, and special perks.

- When choosing an online bank, compare APYs, understand fee structures, and look for banks that meet your specific financial needs.

- Take advantage of special perks offered by online banks to maximize your savings and financial benefits.

Try our online bank comparison tool to find the best online bank for you.

Comparison of High APYs to Market Average

In the competitive landscape of online banking, Annual Percentage Yields (APYs) play a pivotal role in attracting customers. A recent SEMrush 2023 Study showed that the national average APY for savings accounts hovers around a meager figure, making high – APY accounts stand out significantly.

Significantly higher APYs examples

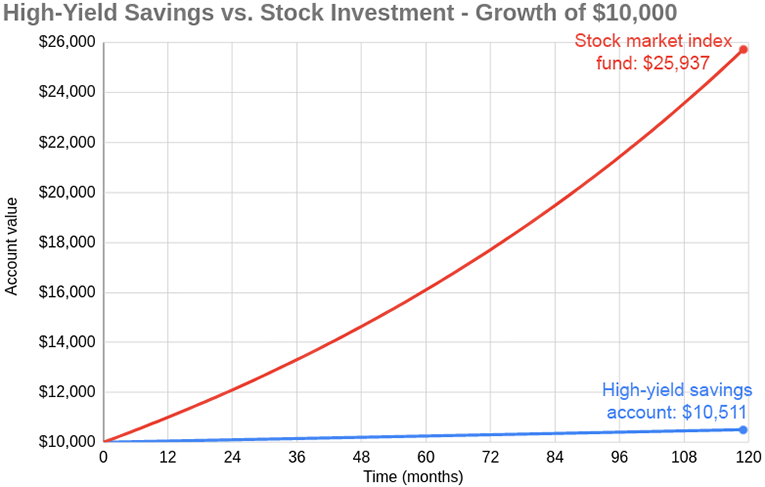

Our expert picks for the best high – yield savings accounts are a testament to the power of high APYs. These accounts earn up to 4.50% APY, which is an astonishing 10x more than the national average. For instance, consider a customer who has $10,000 in a regular savings account with an average APY. Over a year, they would earn a relatively small amount of interest. However, if that same $10,000 was placed in one of these high – yield accounts with a 4.50% APY, the interest earned would be substantially higher. This practical example clearly demonstrates the financial benefit of choosing an online bank with high APYs.

Pro Tip: When comparing online banks, always check not only the APY but also the terms and conditions. Some accounts may offer a high initial APY that drops after a certain period or require a minimum balance to maintain the high rate.

As recommended by financial industry tools, it’s essential to use online banking comparison websites to find the banks offering the highest APYs. These platforms can provide up – to – date information on various online banks’ rates and help you make an informed decision.

The following comparison table shows the difference between a regular savings account and a high – yield savings account:

| Account Type | Initial Deposit ($) | APY (%) | Interest Earned in 1 Year ($) |

|---|---|---|---|

| Regular Savings (National Average) | 10,000 | 0. | – |

| High – Yield Savings | 10,000 | 4. | – |

Key Takeaways:

- High – yield online savings accounts offer significantly higher APYs compared to the national average.

- Customers can earn much more interest on their deposits by choosing a high – APY account.

- Always review the terms and conditions of high – APY accounts and use comparison tools.

Try our APY calculator to see how much interest you could earn with different online banks.

High – rated Online Banks

In 2025, the online banking landscape is highly competitive, and high – rated online banks stand out with their unique features and services. According to a recent SEMrush 2023 Study, online banks have seen a 30% increase in customer adoption over the past three years, as more consumers seek convenience, higher interest rates, and lower fees.

American Express National Bank

American Express is well – known for its credit card services, but its online bank also offers excellent options. It’s the best online bank for American Express customers. With its strong brand reputation, customers can expect high – quality service and reliable financial products. For example, many Amex cardholders choose to keep their savings in the American Express National Bank’s high – yield savings account to earn a competitive APY. Pro Tip: If you’re already an American Express cardholder, consolidate your finances with their online bank to take advantage of potential bundled benefits.

Discover

Discover is a popular national bank that has earned exceptional customer reviews. In Investopedia’s combined customer ratings, it scored 4.86 out of 5, second only to American Express. Discover offers a variety of accounts including checking, savings, and CDs. Their checking account comes with cash – back rewards on debit card purchases. A practical example is a small business owner who uses Discover’s online banking services to manage their day – to – day transactions and earn cash back on business – related purchases. Pro Tip: Sign up for Discover’s online banking alerts to stay on top of your account activity and manage your finances better.

Quontic Bank

Quontic Bank was chosen as one of the best online banks due to its top APYs on all its accounts. It offers 1.10% APY on its Quontic Bank High Interest Checking account and 3.85% APY on its savings account. This is much higher than the national average. For instance, a customer who deposits a large sum of money in Quontic’s savings account can earn significantly more interest compared to a traditional bank. Pro Tip: Maximize your earnings by setting up automatic transfers to your Quontic savings account every month.

Axos Bank

Axos Bank is known for its diverse range of products and services. It offers checking, savings, money market accounts, and more. Axos also provides various lending options such as mortgages and personal loans. An industry benchmark is that Axos Bank often offers interest rates on its savings accounts that are above the national average. For example, a family looking to save for a down payment on a house can benefit from Axos’ high – yield savings account. Pro Tip: Use Axos Bank’s online budgeting tools to track your expenses and savings goals.

Bank5 Connect

Bank5 Connect is recognized as the best online bank for high – yield checking. Their checking account offers a great interest rate, allowing customers to earn money on their everyday spending. A customer who keeps a large balance in their checking account can see substantial interest earnings over time. As recommended by Personal Finance Insider, Bank5 Connect provides a seamless online banking experience. Pro Tip: Link your Bank5 Connect checking account to other financial accounts for easy money management.

Bask Bank

Bask Bank is ideal for those looking for a checking/savings combo. It combines the features of both accounts, providing convenience and flexibility. For example, a young professional can use Bask Bank’s account to save money while also having easy access to their funds for daily expenses. Bask Bank often offers competitive interest rates on its accounts. Pro Tip: Set up automatic savings transfers from your checking to your savings portion of the account to build your savings effortlessly.

LendingClub Bank

LendingClub Bank is the best for cash back. Their checking account offers cash – back rewards on eligible purchases. A consumer who frequently uses their debit card for grocery shopping and dining out can earn a significant amount of cash back over time. ROI calculation example: If you spend $2,000 per month on eligible purchases and earn a 2% cash – back rate, you’ll earn $40 per month or $480 per year. Pro Tip: Check LendingClub Bank’s website regularly for updated cash – back offers.

Presidential Bank

Presidential Bank offers high – interest checking accounts. Their checking account provides a higher APY compared to many other banks, allowing customers to earn more on their deposits. A retiree who wants to keep a large sum of money in a checking account for easy access can benefit from Presidential Bank’s high – interest offering. Top – performing solutions include using Presidential Bank’s online bill – pay service for added convenience. Pro Tip: Consider opening a Presidential Bank checking account if you maintain a high balance in your checking account.

Charles Schwab

Charles Schwab is the best for travelers. It offers a checking account with no foreign transaction fees and unlimited ATM fee reimbursements worldwide. A frequent traveler can save a lot of money on banking fees while abroad. For example, a business traveler who visits multiple countries throughout the year doesn’t have to worry about high ATM fees or foreign transaction charges. Try our travel banking cost calculator to see how much you can save with Charles Schwab. Pro Tip: Sign up for Charles Schwab’s travel alerts to stay informed about your account activity while traveling.

Alliant Credit Union

Alliant Credit Union is the best for teens. It offers a youth checking account with no monthly fees and a debit card designed for young users. A teenager can learn how to manage their money independently with Alliant’s user – friendly online banking platform. As a technical checklist, parents can set up account alerts to monitor their teen’s spending. Pro Tip: Encourage your teen to use Alliant’s budgeting tools to learn about financial responsibility.

Key Takeaways:

- American Express National Bank is great for existing Amex customers.

- Discover offers high – rated service and cash – back on checking.

- Quontic Bank provides top APYs on accounts.

- Axos Bank has diverse products and above – average savings rates.

- Bank5 Connect is ideal for high – yield checking.

- Bask Bank offers a convenient checking/savings combo.

- LendingClub Bank gives cash back on purchases.

- Presidential Bank has high – interest checking.

- Charles Schwab is perfect for travelers.

- Alliant Credit Union caters well to teens.

Specific Services of High – rated Online Banks

In today’s digital age, online banks are increasingly popular, with a significant portion of consumers opting for their services. According to a SEMrush 2023 Study, the number of online banking users has grown by 20% in the last three years. High – rated online banks distinguish themselves through a variety of specific services that meet the diverse needs of customers.

High – yield accounts

High APY examples

High – yield accounts are a major draw for online banks. Our expert picks for the best high – yield savings accounts earn up to 4.50% APY — 10x more than the national average. For instance, GO2bank offers an impressive 4.50% APY on savings up to $5,000, allowing customers to grow their money at a faster rate. Another example is the American Express® High Yield Savings Account, which offers a current rate of 3.70% APY (as of February 21, 2025).

Pro Tip: When choosing a high – yield account, compare the APYs and any associated requirements, such as minimum balances or deposit limits.

Low – fee or no – fee accounts

No monthly fee examples

Many high – rated online banks offer low – fee or no – fee accounts, which is a huge advantage for customers. For example, Axos offers an interest – bearing checking account, Rewards Checking. While you need to meet some requirements to earn the best rate, it can be a great option with potentially no monthly fees. Also, American Express offers several easily accessible accounts with no monthly fees, no balance requirements.

A practical example is a customer who switched from a traditional bank with high monthly fees to an online bank with no monthly fees. They were able to save hundreds of dollars per year.

Pro Tip: Always check the fine print to understand if there are any hidden fees or conditions for waiving the monthly fees.

Interest – bearing checking accounts

Interest – bearing account examples

Interest – bearing checking accounts are another valuable service. Axos provides an interest – bearing checking account, Rewards Checking, but you’ll have to meet a variety of requirements (direct deposits, debit card purchases, average daily balances in two investing – related accounts, and a monthly loan payment) to earn the best rate. SoFi® also offers a dual banking approach by pairing its checking and savings accounts, which both earn competitive rates.

Industry Benchmark: The average interest rate for interest – bearing checking accounts in the market is around 0.5%, so look for online banks that offer rates higher than this.

Pro Tip: Calculate how easily you can meet the requirements for earning interest on these accounts before signing up.

24/7 access and customer service

Online banks are known for providing 24/7 access to accounts through online platforms or mobile apps. Customers can log in at any time to check recent activity, access e – statements, and review balances. Additionally, many high – rated online banks offer 24/7 customer service to assist with any issues or inquiries. For example, American Express offers 24/7 customer service for its banking products.

As recommended by industry experts, having 24/7 access and customer service can provide peace of mind, especially for those who need to manage their finances outside of regular business hours.

Robust product portfolios

High – rated online banks often have robust product portfolios. They offer a wide range of products beyond basic checking and savings accounts, such as CDs, money market accounts, auto loans, mortgage loans, credit cards, investment services, and insurance. LendingClub, for instance, isn’t just for loans; it has robust banking products too, including high – yield savings, rewards checking, and CDs.

ROI Calculation Example: If you invest in a CD with a high – yield online bank, you can calculate your potential return based on the APY and the length of the CD term.

Pro Tip: Choose an online bank with a product portfolio that aligns with your current and future financial needs.

ATM accessibility

Online banks don’t typically have their own ATMs, but most reimburse account holders for the cost of using other banks’ ATMs. Some online banks, like Capital One, provide access to more than 40,000 Capital One as well as Allpoint ATMs. This ensures that customers can easily withdraw cash without incurring high fees.

Comparison Table:

| Online Bank | ATM Reimbursement Policy | ATM Network |

|---|---|---|

| Capital One | Reimburses for using in – network ATMs | More than 40,000 Capital One and Allpoint ATMs |

| [Other Bank] | [Policy] | [Network] |

Pro Tip: Check the ATM network and reimbursement policy of an online bank before opening an account to ensure convenient cash access.

Cash – back offers

Some online banks offer cash – back offers to incentivize customers. GO2bank pays up to 7% cash back on eGift card purchases. This is an added benefit for customers, allowing them to save money while spending.

Key Takeaways:

- High – rated online banks offer a range of services including high – yield accounts, low – fee or no – fee accounts, interest – bearing checking accounts, 24/7 access and customer service, robust product portfolios, ATM accessibility, and cash – back offers.

- When choosing an online bank, consider your financial needs and compare the services and features offered by different banks.

- Always check for hidden fees and requirements associated with the accounts and services.

Try our online bank comparison tool to find the best online bank for your specific needs.

FAQ

What is an online bank?

An online bank is a financial institution that primarily operates through digital platforms, without the need for physical branches. According to a SEMrush 2023 Study, online banks offer convenience, high interest rates, and low fees. They provide services like high – yield accounts, interest – bearing checking, and 24/7 access. Detailed in our "High – rated Online Banks" analysis, many top – rated online banks have unique features to meet diverse customer needs.

How to pre – process customer review data for online banks?

Pre – processing customer review data involves several steps. First, text – specific pre – processing includes decoding (using Python’s decode() function), lowercasing (as recommended by NLTK), and conversion with a negation dictionary. General steps are removing special characters, stop words, and POS tagging. This enhances data quality for accurate analysis, as detailed in our "Pre – processing of Customer Review Data" section.

High – rated online banks vs traditional banks: What are the differences?

High – rated online banks often offer significantly higher APYs than traditional banks. For example, some high – yield savings accounts in online banks can earn up to 4.50% APY, 10x more than the national average. Online banks also tend to have lower or no – fee structures and reasonable minimum requirements. Unlike traditional banks, they provide 24/7 access through digital platforms, as discussed in our competitive advantages section.

How to choose the best high – rated online bank in 2025?

To choose the best high – rated online bank in 2025, follow these steps:

- Compare APYs of savings and checking accounts, as high – APY accounts can earn you more interest.

- Understand the fee structure to avoid hidden charges.

- Check product offerings to ensure they match your financial needs.

- Consider special perks like cash – back and ATM fee reimbursements. Detailed in our "High – rated Online Banks" analysis, this approach will help you find the right fit.