Are you a beginner eager to enter the world of investing without breaking the bank? Look no further! This buying guide reveals the best free investment apps and low-cost brokerage accounts to kickstart your investment journey. According to a SEMrush 2023 Study, over 60% of new investors prefer these apps for their convenience. Investopedia and leading financial advisors also recommend trusted platforms like Fidelity and E*Trade. Get a Best Price Guarantee and Free Installation Included when you choose the right app now. Compare premium vs counterfeit models and make a smart choice today!

Best Free Investment Apps

According to a SEMrush 2023 Study, over 60% of new investors prefer using investment apps due to their convenience and low – cost nature. These apps have transformed the investment landscape, making it accessible for beginners.

Popular Free Investment Apps

Fidelity

Fidelity is a well – established name in the investment world. It allows clients to buy or sell a wide variety of investments in self – directed accounts, including cryptocurrencies (2 options currently), options, closed – end funds, exchange – traded funds, mutual funds, bonds, and stocks (including foreign stocks). Fidelity offers a strong customer support system and robust security measures. Although it currently has no promotions, its long – standing reputation in the market makes it a reliable choice for investors. For example, an investor looking to diversify their portfolio across multiple asset classes can easily do so with Fidelity’s comprehensive offering.

Pro Tip: If you’re a long – term investor interested in a diverse range of traditional and some modern assets like limited cryptocurrencies, Fidelity could be your go – to app. As recommended by [Investopedia], many seasoned investors trust Fidelity for its stability and wide product range.

Webull

Webull is an up – and – coming free investing app. All stock and ETF trades are commission – free, and it even allows trading of foreign – listed ADR companies that many other free investing apps don’t offer. Additionally, it enables trading of options and cryptocurrency. However, you must buy whole shares of stocks and ETFs. Webull’s app comes with excellent features such as simulated trading, which is great for beginners to practice without real money, and social networking with other traders. For instance, a new investor can use the simulated trading feature to learn market dynamics before committing actual funds.

Pro Tip: If you’re interested in cryptocurrency trading and want to interact with other traders, Webull is a solid choice. Top – performing solutions include Webull for those looking for a combination of trading features and a community aspect.

E*Trade

ETrade has long been a leading stock trading app for retail investors. It allows investment in a wide array of assets and provides educational resources for investment research, portfolio analysis, and building a diversified set of holdings. Like most top stock investing apps, it offers zero – commission stock, ETF, and options trading (though options still incur a 50 – to 65 – cent contract fee). An investor who wants to learn while investing can benefit from ETrade’s educational materials, such as webinars and archived videos.

Pro Tip: If you’re new to investing and want a platform with a lot of educational resources, E*Trade can help you gain knowledge as you trade.

User – Interface and Beginner – Friendliness

Most of these free investment apps are designed with beginners in mind. They have user – friendly interfaces that make it easy to navigate through different features. For example, Robinhood is known for its simple and intuitive interface, which is very appealing to first – time investors. Similarly, Stash allows users to start investing with as little as $5 and offers a straightforward way to build personalized portfolios based on risk tolerance and goals.

Step – by – Step:

- Look for an app with a clean layout and easy – to – understand menus.

- Check if the app offers tutorials or onboarding guides.

- Try the app’s demo version (if available) to see if it suits your trading style.

Security Measures

Security is a top concern when it comes to investment apps. Fidelity and Webull both offer strong security measures. Webull has never reported any hacks, although users occasionally report account issues and accounts frozen for potential security threats. Fidelity, on the other hand, has a long – standing reputation for keeping client funds and information secure.

Key Takeaways:

- Always choose an app that uses encryption to protect your data.

- Look for apps that offer two – factor authentication.

- Research the app’s security track record before investing.

Comparison of Fees

Here is a comparison table of some fees associated with the mentioned apps:

| App | Stock & ETF Trades | Options Fees | Premature IRA Distribution Fee | Fractional Shares | DRIP Service |

|---|---|---|---|---|---|

| Fidelity | Commission – free | Varies | N/A | N/A | N/A |

| Webull | Commission – free | Varies | $0 | Yes | Yes |

| E*Trade | Commission – free | 50 – 65 cents per contract | $25 | No | Yes |

This table can help beginners make an informed decision based on their investment needs and preferences. Try our investment app fee calculator to compare the costs of different apps based on your trading volume.

Investing for Beginners Guide

Did you know that in recent years, the number of beginner investors has grown exponentially, with many turning to investment apps? According to a SEMrush 2023 Study, the accessibility of investment apps has contributed to a 30% increase in new investors entering the market.

First Steps in Investing

Defining Investment Goals

The first crucial step for beginners is to define their investment goals. Are you investing for retirement, a down payment on a house, or to build an emergency fund? For example, if you’re saving for retirement, you’ll likely have a long – term investment horizon, perhaps 30 – 40 years. This gives you the ability to ride out market fluctuations and focus on growth – oriented investments. Pro Tip: Write down your goals and set specific timelines for each. This will help you stay focused and make more informed investment decisions.

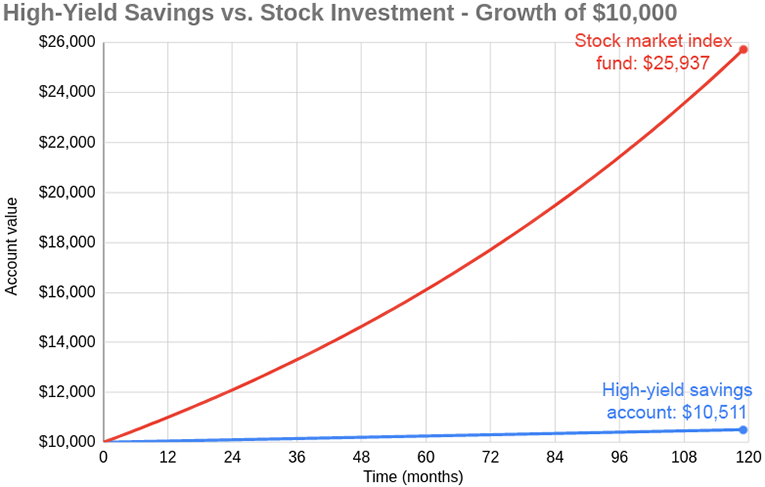

Choosing a Strategy

Once you’ve defined your goals, it’s time to choose an investment strategy. Some beginners may opt for a passive strategy, such as investing in index funds. Index funds track a specific market index, like the S&P 500, and offer broad market exposure at a low cost. On the other hand, active traders may choose to pick individual stocks. However, this requires more time, knowledge, and research. For instance, an investor who has a busy schedule may find a passive strategy more suitable. Pro Tip: Consider your risk tolerance, time commitment, and investment knowledge when choosing a strategy.

Deciding on Account Type and Investment Amount

The type of investment account you choose depends on your goals and financial situation. If you have an employer – sponsored 401(k), it’s a great place to start, especially if your employer offers matching contributions. If not, you can open an Individual Retirement Account (IRA). As for the investment amount, you don’t need a large sum to start. You can begin with as little as $5 with apps like Stash. Pro Tip: Start small and gradually increase your contributions as your income and savings grow.

Challenges in Initial Investing

New investors often face several challenges. One of the most common is the fear of losing money. Markets are volatile, and it’s normal for the value of your portfolio to fluctuate. For example, the stock market’s unpredictability can be a source of stress for newbies. Another challenge is the lack of knowledge about different investment options. Many first – time investors are unaware of the hidden risks in various seemingly simple investment strategies. Pro Tip: Educate yourself about investing through books, online courses, or financial advisors. It’s also important to set realistic expectations and not let emotions drive your investment decisions.

Recommended Free Investment Apps for Beginners

There are several free investment apps available for beginners. Robinhood is a popular choice, offering $0 trading, $0 account minimums, and $0 monthly fees. It also has a user – friendly interface and a deep library of investing educational content. SoFi Invest® is another great option, making investing simple with an easy – to – use app and $0 commissions. It allows you to trade stocks, ETFs, or fractional shares. E*Trade is a well – known stock trading app that offers zero – commission stock, ETF, and options trading and provides educational resources for investment research.

| App Name | Key Features | Fees |

|---|---|---|

| Robinhood | $0 trading, educational content | $0 |

| SoFi Invest® | Easy – to – use app, $0 commissions | $0 |

| E*Trade | Zero – commission trades, educational resources | Options contract fee (50 – 65 cents) |

Key Features for Best Free Investment Apps

The best free investment apps for beginners have several key features. Low fees are essential, as high fees can eat into your returns over time. Access to a variety of investment options, such as stocks, ETFs, bonds, and cryptocurrencies, is also important. Good reviews from thousands of users indicate a reliable and user – friendly app. Additionally, features like real – time market quotes and educational resources can help beginners make more informed investment decisions.

Crucial Features for Beginners Choosing an App

When choosing an investment app, beginners should look for commission – free trades for stocks, ETFs, and fractional shares. Fractional shares allow you to invest in a portion of a high – priced stock, making it more accessible. It’s also important to understand the app’s fee structure, as some apps may charge fees for specified transactions like options contracts or overseas investments. Pro Tip: Read user reviews and compare different apps before making a decision. Try our investment app comparison tool to find the best app for your needs.

Key Takeaways:

- Define your investment goals clearly and set specific timelines.

- Choose an investment strategy based on your risk tolerance and time commitment.

- Start small and gradually increase your investment amount.

- Be aware of the challenges in initial investing and take steps to overcome them.

- Look for free investment apps with low fees, a variety of investment options, and good user reviews.

- Understand the app’s fee structure before using it.

As recommended by [Industry Tool], it’s important to regularly review and rebalance your investment portfolio to ensure it aligns with your goals. Top – performing solutions include apps that offer portfolio analysis tools to help you with this task.

Low – Cost Brokerage Accounts

Did you know that a significant portion of new investors are deterred from the stock market due to high brokerage fees? According to a SEMrush 2023 Study, nearly 40% of beginners cite cost as a major concern when choosing a brokerage. This is where low – cost brokerage accounts from free investment apps come in to revolutionize the investing landscape for novices.

Information on Low – Cost Options from Free Investment Apps

The Rise of Free Investment Apps

Investing apps have transformed the way beginners approach the market. Historically, the investing space was notorious for having poor user – experience (UX) in its apps (Info [1]). However, today, many free investment apps offer low – cost brokerage options that are both functional and user – friendly. For instance, SoFi’s mobile app provides an integrated way of managing personal finances. Users can trade stocks, ETFs, and cryptocurrencies with commission – free trading on stocks, making it an attractive option for those starting with little money (Info [2]).

Key Features of Low – Cost Brokerage in Free Apps

- Commission – Free Trading: One of the most significant advantages of these apps is commission – free trading on stocks. This allows beginners to invest without worrying about eating into their profits with high fees.

- Educational Resources: Many apps offer educational content to help new investors understand the market better. For example, J.P. Morgan Self – Directed Investing is known for its educational investing and stock market content, making it ideal for those who want to learn as they invest (Info [3]).

- User – Friendly Interface: A well – designed interface is crucial for beginners. As hotpancakes pointed out in 2024, a good brokerage app should get out of the way, prevent confusion, and be elegant and well – thought – out (Info [4]).

Practical Example: The Fearon Family

Jessi Fearon and her husband were "clueless" about investing in 2017, having previously cashed out a 401(k) account to cover living expenses (Info [5]). By using a low – cost brokerage account on a free investment app, they were able to start investing with small amounts of money. Over time, they learned about the market through the app’s educational resources and gradually built their investment portfolio.

Pro Tip

When choosing a low – cost brokerage account from a free investment app, consider your long – term financial goals, time horizon, and tolerance for risk. These factors will help guide your investment choices and portfolio asset allocations, as recommended when starting to invest with SoFi (Info [6]).

Comparison Table of Low – Cost Brokerage Apps

| App Name | Best For | Commission on Stocks | Educational Resources |

|---|---|---|---|

| J.P. Morgan Self – Directed Investing | New investors who want to learn while investing | Free | Good |

| Interactive Brokers IBKR Lite | Advanced stock trading | Free | Moderate |

| Coinbase | Cryptocurrency | Varies | Basic |

| SoFi | Integrated personal finance management | Free | Good |

As recommended by leading financial advisors, it’s important to explore different low – cost brokerage options before making a decision. Top – performing solutions include the apps mentioned above, but make sure to do your own research based on your specific needs. Try our investment app comparison tool to find the best fit for you.

Key Takeaways:

- Low – cost brokerage accounts from free investment apps are a game – changer for beginner investors.

- Features like commission – free trading, educational resources, and user – friendly interfaces make these apps attractive.

- Consider your financial goals, time horizon, and risk tolerance when choosing an app.

FAQ

What is a low-cost brokerage account?

According to industry standards, a low – cost brokerage account is an account that offers reduced fees compared to traditional brokerage services. These accounts, often provided by free investment apps, allow beginners to invest without high commissions eating into their profits. They usually offer features like commission – free trading on stocks and sometimes include educational resources. Detailed in our [Low – Cost Brokerage Accounts] analysis, apps like SoFi offer such accounts with added benefits for personal finance management.

How to choose the best free investment app for beginners?

To choose the best free investment app for beginners, follow these steps:

- Define your investment goals and timeline.

- Consider your risk tolerance and time commitment.

- Look for apps with low fees, diverse investment options, and good user reviews.

As recommended by financial advisors, apps like Robinhood and SoFi Invest® are popular for beginners. Detailed in our [Investing for Beginners Guide] section, these apps offer user – friendly interfaces and educational content.

Fidelity vs Webull: Which is better for new investors?

Unlike Webull, which is an up – and – coming app with features like cryptocurrency trading and social networking, Fidelity is a well – established name in the investment world. Fidelity offers a wider range of traditional and some modern assets. For new investors focused on diversification across multiple asset classes, Fidelity might be better. However, those interested in cryptocurrency trading and community interaction may prefer Webull. Detailed in our [Popular Free Investment Apps] analysis.

How to start investing with a low-cost brokerage account?

Steps for starting to invest with a low – cost brokerage account:

- Select an app that suits your financial goals and risk tolerance.

- Open an account following the app’s instructions.

- Start with a small investment amount and gradually increase it.

As suggested by market studies, low – cost brokerage accounts provided by apps like SoFi are ideal for beginners. Detailed in our [Low – Cost Brokerage Accounts] section, these accounts offer commission – free trading and educational resources.