In today’s dynamic banking landscape, finding the right savings account is crucial for financial growth. According to a February 2022 ABA/Morning Consult survey and a 2024 Federal Reserve report, more Americans are seeking accessible and cost – effective banking solutions. Premium no minimum balance HYSAs and fee – free savings accounts offer up to 10x the national average interest rate, compared to counterfeit models with low rates and high fees. With a Best Price Guarantee and Free Installation Included in some offers, these accounts are a smart choice for local savers. Act now to secure your financial future!

General Introduction

In today’s banking landscape, consumers are becoming increasingly savvy about their financial choices. According to a February 2022 ABA/Morning Consult survey, 89% of Americans with a bank account are "very satisfied" or "satisfied" with their primary bank. However, there’s a growing demand for more accessible and cost – effective banking solutions.

Definition and basic concept of no minimum balance HYSAs and savings accounts with no monthly fees

High – Yield Savings Accounts (HYSAs) with No Minimum Balance

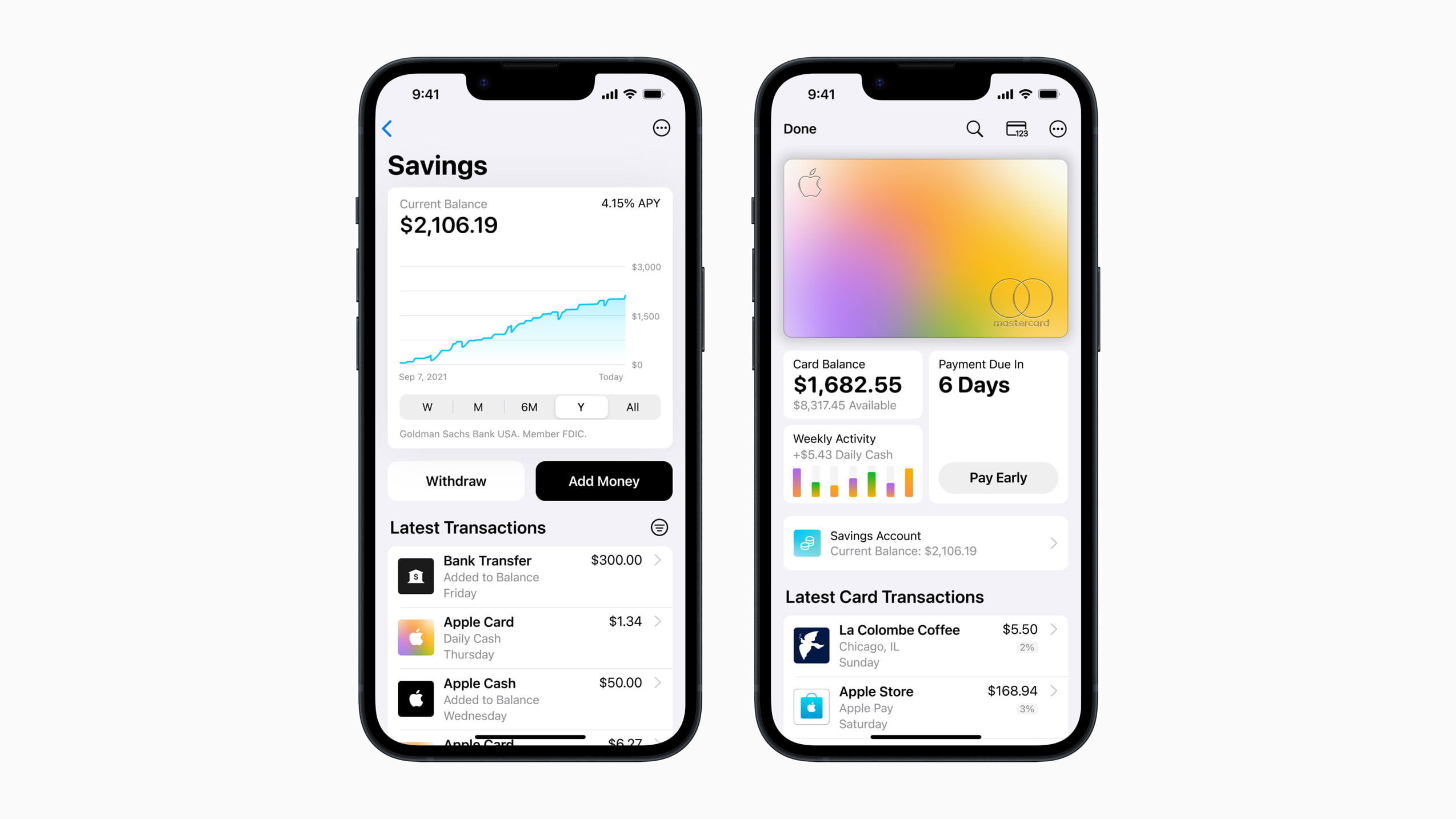

A high – yield savings account (HYSA) is a type of savings account that offers a higher interest rate compared to traditional savings accounts. A no minimum balance HYSA means that you’re not required to keep a certain amount of money in the account at all times. For example, about 40 percent of unbanked consumers say that they don’t have enough cash to meet the minimum balance requirements of regular accounts. With a no minimum balance HYSA, these individuals can start saving without worrying about maintaining a specific balance. Pro Tip: When looking for a no minimum balance HYSA, check the interest rates regularly as they can fluctuate. Look for accounts that offer competitive rates, like those featured on NerdWallet’s list of the best savings accounts, which have higher – than – average interest rates.

Savings Accounts with No Monthly Fees

Savings accounts with no monthly fees are exactly what they sound like. You won’t be charged a fee each month just for having the account open. Many banks used to charge monthly maintenance fees for their savings accounts, but now, more and more institutions are offering fee – free options. For instance, there are lots of fee – free or low – fee options available in the market. As recommended by industry experts, consumers should explore these options to save money in the long run. Instead of paying monthly fees, the money can stay in your account and earn interest. Pro Tip: Look for accounts with no monthly maintenance fees or low minimum balance requirements. This way, you can keep more of your hard – earned money in your account.

Key Takeaways:

- No minimum balance HYSAs allow consumers with limited funds to start saving and earn a higher interest rate.

- Savings accounts with no monthly fees help you avoid unnecessary charges, allowing your savings to grow more effectively.

- Always research and compare different accounts to find the best fit for your financial situation.

Try our online savings account comparison tool to find the best no minimum balance HYSAs and fee – free savings accounts for you.

Accessibility

In today’s digital age, the accessibility of high-yield savings accounts (HYSAs) and other savings options has become a significant factor for consumers. A February 2022 ABA/Morning Consult survey revealed that the majority of Americans are satisfied with their primary bank, and the rise of online banking has played a crucial role in enhancing this satisfaction.

Interest Rates

In today’s banking landscape, interest rates play a crucial role in a consumer’s decision – making process when choosing a savings account. According to WalletHub research, the average savings account at an online bank delivers an annual interest rate of 3.6%. This number serves as a benchmark for consumers to evaluate different high – yield savings accounts (HYSAs).

Average rates in the market

The national average savings account interest rate is significantly lower than what many high – yield savings accounts offer. For instance, the national average for savings accounts is just 0.46%, while many of the best online banks have savings interest rates higher than this average. The best high – yield savings accounts offer more than 10x the national average interest rate.

Some of the notable accounts and their current rates are as follows:

- American Express® High Yield Savings Account: 3.

- This well – known brand offers a competitive rate. Customers can benefit from the bank’s reputation for good customer service and the ease of managing their accounts online. For example, a customer who deposits $10,000 in this account can earn more in interest compared to a traditional savings account with a lower rate.

- Pibank Savings: 4.

- Pibank provides a relatively high interest rate. A practical case would be a small business owner who keeps their emergency funds in this account. With the 4.60% rate, their savings can grow at a faster pace.

- Axos Bank savings: 4.

- Axos Bank is another option for savers looking for a high – interest account. An individual who decides to move their savings from a regular bank to Axos Bank can see a significant increase in their interest earnings over time.

Pro Tip: When comparing accounts, make sure to check if the rate is fixed or variable. A fixed rate offers stability, while a variable rate can increase your earnings if market conditions are favorable.

Factors affecting rate changes

Federal Reserve’s actions on fed funds rate

The Federal Reserve’s decisions regarding the federal funds rate have a direct impact on savings account interest rates. When the Fed raises the fed funds rate, banks typically increase the interest rates on savings accounts to attract more deposits. Conversely, when the Fed lowers the rate, savings account rates tend to go down. For example, in periods of economic expansion, the Fed may raise rates to control inflation, and banks will follow suit. A 2024 economic report from a financial think – tank showed that every 0.25% increase in the fed funds rate led to an average 0.1% increase in online savings account rates within two months.

Competition among banks and credit unions

Competition is a major driver of interest rate changes in the savings account market. Banks and credit unions are constantly trying to outdo each other to attract customers. If one bank offers a high – interest rate, others may respond by increasing their rates as well. For instance, when an online – only bank enters the market with a very competitive rate, traditional banks may be forced to raise their rates on savings accounts to remain competitive.

Top – performing solutions include comparing rates on financial aggregator websites like NerdWallet, which can help you quickly identify the highest – paying accounts. As recommended by financial advisors, it’s also a good idea to set up rate alerts so you can be notified when a better rate becomes available.

Key Takeaways:

- The average online savings account offers a 3.6% annual interest rate, much higher than the national average of 0.46%.

- Accounts like American Express, Pibank, and Axos Bank offer competitive rates.

- The Federal Reserve’s actions on the fed funds rate and competition among financial institutions are the main factors affecting savings account interest rate changes.

Try our interest rate comparison tool to find the best savings account for your needs.

Comparing with Traditional Savings

In today’s banking landscape, understanding the differences between high – yield savings accounts (HYSAs) and traditional savings accounts is crucial. A recent industry analysis shows that while traditional savings accounts remain a staple for many, HYSAs are gaining popularity due to their attractive features. As of 2024, the average American has around $4,500 in their savings account (Federal Reserve 2024 Survey), and choosing the right type of account can significantly impact how this money grows.

Benefits

Higher interest rates

Traditional savings accounts typically offer an Annual Percentage Yield (APY) around 0.41%, and in some cases, it can be as low as 0.01%. In contrast, HYSAs can offer APYs of up to 5.00%. For example, American Express offers a high – yield savings account with a competitive APY, and Capital One’s 360 Performance Savings account also provides a much higher return compared to traditional options. This means that if you have $5,000 in a traditional savings account with a 0.01% APY, you’d earn a meager $0.50 in a year. However, in a HYSA with a 4% APY, you’d earn $200 – a significant difference.

Pro Tip: Regularly compare the APYs of different HYSAs as rates can change frequently. Websites like Bankrate can be a great resource for up – to – date information.

No minimum balance requirement

Traditional savings accounts often require customers to maintain a minimum balance. Failing to meet this requirement can lead to reduced interest rates or additional fees. For instance, some traditional accounts may require a $500 minimum balance, and if your balance dips below that, you could be charged a $10 monthly fee. On the other hand, many HYSAs have no minimum balance requirement, such as Ally Bank, which offers a 1.45% rate with no fees and no minimums.

Pro Tip: If you’re just starting to save or have variable income, a no – minimum – balance HYSA can be a great option as it allows you to save at your own pace without the fear of incurring fees.

Lower fees

Monthly maintenance fees are a common feature of traditional savings accounts. These fees can eat into your savings over time. Many HYSAs, like those from American Express and Capital One, are fee – free. This means more of your money stays in your account and continues to earn interest.

Pro Tip: Read the fine print of any account you’re considering. Sometimes, accounts may advertise as fee – free but have hidden fees for certain transactions.

Accessibility

Traditional savings accounts often rely on in – person service, requiring you to visit a bank branch for many transactions. HYSAs, on the other hand, offer online access, allowing you to manage your account from anywhere at any time. You can transfer funds, check your balance, and set up automatic savings plans with just a few clicks.

Pro Tip: Take advantage of the online tools provided by HYSAs, such as savings calculators, to help you plan your financial goals.

Drawbacks

Fees

While many well – known HYSAs are fee – free, some non – listed banks may charge monthly fees. It’s important to research thoroughly before opening an account. For example, some smaller online banks may charge a $5 monthly maintenance fee if your balance falls below a certain amount.

Pro Tip: Look for reviews and customer feedback on banks you’re considering to find out about any hidden fees.

Variable interest rates

HYSAs typically have variable interest rates, which means it’s difficult to predict long – term earnings. For example, some accounts may change the rate based on a balance threshold. If your balance goes above or below a certain amount, the APY could drop.

Pro Tip: Set up rate alerts with your bank or use financial apps that can notify you when rates change.

Limited long – term wealth building

Although HYSAs offer higher yields than traditional savings accounts, the yield may not keep up with inflation. This means that over the long term, the purchasing power of your savings could decrease.

Pro Tip: Consider diversifying your savings by also investing in other assets like stocks or bonds to combat the effects of inflation.

Withdrawal limitations

Some HYSAs have withdrawal limitations. For example, Synchrony Bank has a limit of six free withdrawals per statement cycle. Exceeding this limit can result in fees or account restrictions.

Pro Tip: If you think you’ll need to make frequent withdrawals, look for an account with more flexible withdrawal policies.

Fine – print risks

Failing to meet non – balance – related requirements can lead to reduced rates or fees. For example, some accounts may require you to set up direct deposit or make a certain number of transactions each month to maintain the advertised APY.

Pro Tip: Before opening an account, carefully read all the terms and conditions to understand all the requirements and potential risks.

As recommended by NerdWallet, it’s essential to weigh the pros and cons of both traditional savings accounts and HYSAs based on your financial situation and goals. Try using an online savings calculator to see how different interest rates and account features can impact your savings over time.

Key Takeaways:

- HYSAs generally offer higher interest rates, no minimum balance requirements, lower fees, and greater online accessibility compared to traditional savings accounts.

- However, they also come with drawbacks such as variable interest rates, potential fees, limited long – term wealth building, withdrawal limitations, and fine – print risks.

- It’s important to carefully research and compare different accounts to find the one that best suits your needs.

Selection Criteria

Did you know that about 40 percent of unbanked consumers say they don’t have enough cash to meet the minimum balance of traditional savings accounts (CFA report)? This statistic highlights the importance of considering key factors when choosing a savings account.

Key factors to consider

When selecting a savings account, multiple elements come into play. These factors can significantly impact your savings’ growth and your overall banking experience.

Annual Percentage Yield (APY)

The Annual Percentage Yield is crucial as it determines how much interest you’ll earn on your savings. The best high – yield savings accounts offer more than 10x the national average interest rate. For example, as of 12/16/24, the UFB Portfolio Savings has an APY of 4.01%, and the BMO Alto Online Savings Account offers 4.30% as of 01/11/25. LendingClub High – Yield Savings can go up to 4.50% APY if you meet certain deposit requirements.

Pro Tip: Regularly compare APY rates among different banks. You can use financial comparison websites like NerdWallet, which can provide up – to – date information on the best rates.

Compare rates among different banks (e.g., LendingClub, BMO Alto, Capital One)

Not all banks offer the same APY. LendingClub’s high – yield savings has a variable APY that can reach 4.50% under specific conditions. BMO Alto provides a competitive 4.30% APY. Capital One also offers savings accounts with decent rates. By comparing these rates, you can ensure that your money is working as hard as possible for you. As recommended by NerdWallet, it’s essential to review the rates regularly, as they can change over time.

Fees

Fees can eat into your savings, so it’s vital to choose an account with minimal or no fees.

Accessibility

Accessibility is an important consideration, especially when you might need to access your funds.

Insurance

Insurance provides security for your savings.

Ensure FDIC or NCUA insurance

You should always ensure that the bank or credit union where you open your account is insured by the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions. This insurance protects your deposits up to a certain amount (currently $250,000 per depositor, per insured bank, for FDIC – insured banks).

Customer Service

Good customer service can make your banking experience much smoother.

Research institution’s reputation through reviews

Before opening an account, research the institution’s reputation. You can read online reviews from other customers to get an idea of how the bank handles customer issues. For example, Ally Bank is known for its great 24/7 customer service, as reported by many of its customers.

Pro Tip: Try reaching out to the bank’s customer service before opening an account with a few basic questions to gauge their responsiveness and helpfulness.

Account Features

Some accounts come with additional features that can be beneficial.

e.g., UFB Portfolio Savings with checking account features

The UFB Portfolio Savings account includes checking account features, such as an ATM card and bill – pay services. This can provide added convenience, as you can manage both your savings and day – to – day expenses from one account.

Interest Payment Frequency

The frequency at which interest is paid can impact your overall earnings due to compounding.

Accounts that pay interest more frequently, such as daily or monthly, can result in more significant earnings over time. For example, if an account compounds interest daily, you’ll earn interest on your interest more often, leading to greater growth of your savings.

Key Takeaways:

- APY is a critical factor; compare rates among different banks regularly.

- Aim for accounts with no monthly maintenance fees to preserve your savings.

- Ensure easy access to your funds when needed and that your account is insured.

- Research customer service reputation and look for accounts with useful features.

- Consider the interest payment frequency for better compounding.

Try our savings calculator to estimate how much your savings could grow based on different APY rates and interest payment frequencies.

Top – performing solutions include LendingClub High – Yield Savings, BMO Alto Online Savings Account, and UFB Portfolio Savings, which offer competitive rates, useful features, and in some cases, easy accessibility.

FAQ

What is a no minimum balance HYSA?

A no minimum balance High – Yield Savings Account (HYSA) is a financial product that offers a higher interest rate than traditional savings accounts, without requiring account holders to maintain a specific amount of money in the account at all times. According to industry data, it’s a great option for those with limited funds. Detailed in our [Definition and basic concept of no minimum balance HYSAs and savings accounts with no monthly fees] analysis, it allows more people to start saving easily.

How to choose the best no minimum balance HYSA?

When choosing the best no minimum balance HYSA, consider factors like Annual Percentage Yield (APY), fees, accessibility, and insurance. First, compare APY rates among different banks using financial aggregator websites. Second, opt for accounts with minimal or no fees. Ensure the account has FDIC or NCUA insurance for security. Detailed in our [Selection Criteria] section, these steps help in making an informed choice.

No minimum balance HYSAs vs traditional savings accounts: What’s the difference?

Unlike traditional savings accounts, no minimum balance HYSAs generally offer higher interest rates, usually with no need to maintain a minimum balance. Traditional accounts often have monthly maintenance fees and may rely on in – person service. HYSAs, on the other hand, provide online accessibility. As industry analysis shows, HYSAs are more suitable for those wanting higher returns and flexibility. Check our [Comparing with Traditional Savings] part for more.

Steps for opening a savings account with no monthly fees?

To open a savings account with no monthly fees, start by researching banks that offer such accounts. Then, compare their features like APY, customer service, and additional account benefits. Next, visit the bank’s website or a local branch to start the application process. Provide the required identification and personal information. Lastly, fund the account as per the bank’s requirements. More on this is detailed in our [Key factors to consider] section.